georgia ad valorem tax rv

Generally any motor vehicle purchased on or after March 1 2013 and titled in Georgia is exempt from sales and use tax and the. Annual Ad Valorem Tax Applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles Calculate your title tax here.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

. Having done this we just went get our 2000 tag and were hit with 5000 Highway Impact fee which will be an annual fee. It has to fit into the same 10000 limit as your sales tax but if it does youll want to take it. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia.

The current TAVT rate is 66 of the fair market value of the vehicle. Contact your County Tag County Office to see if this tax is due and if due the amount or click here to calculate the amount of ad valorem tax due for your vehicle. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Ad Valorem taxes are calculated based on the vehicles assessed value. In addition if you purchase and title a vehicle between January 1 2012 and March 1 2013 you may be eligible to opt-in to the new title ad valorem tax. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia.

Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly. Georgia ad valorem tax rv Wednesday April 27 2022 You only pay this tax one time. Get the estimated TAVT tax based on the value of the vehicle using.

Problem is theres a 7 ad valorem tax that will be assessed on our RV when we register it based on fair market value. TAVT Annual Ad Valorem Specialty License Plates Dealers. Ad valorem tax or use tax deduction Some states like Massachusetts and Georgia apply a use tax to cars boats and RVs.

Depending on how long you have owned your RV and how long it has been registered and titled in another state in your name will determine how much you have to pay with the one time ad-valorem tax TAVT on your RV when you register it in Georgia. As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. How do I calculate ad valorem tax.

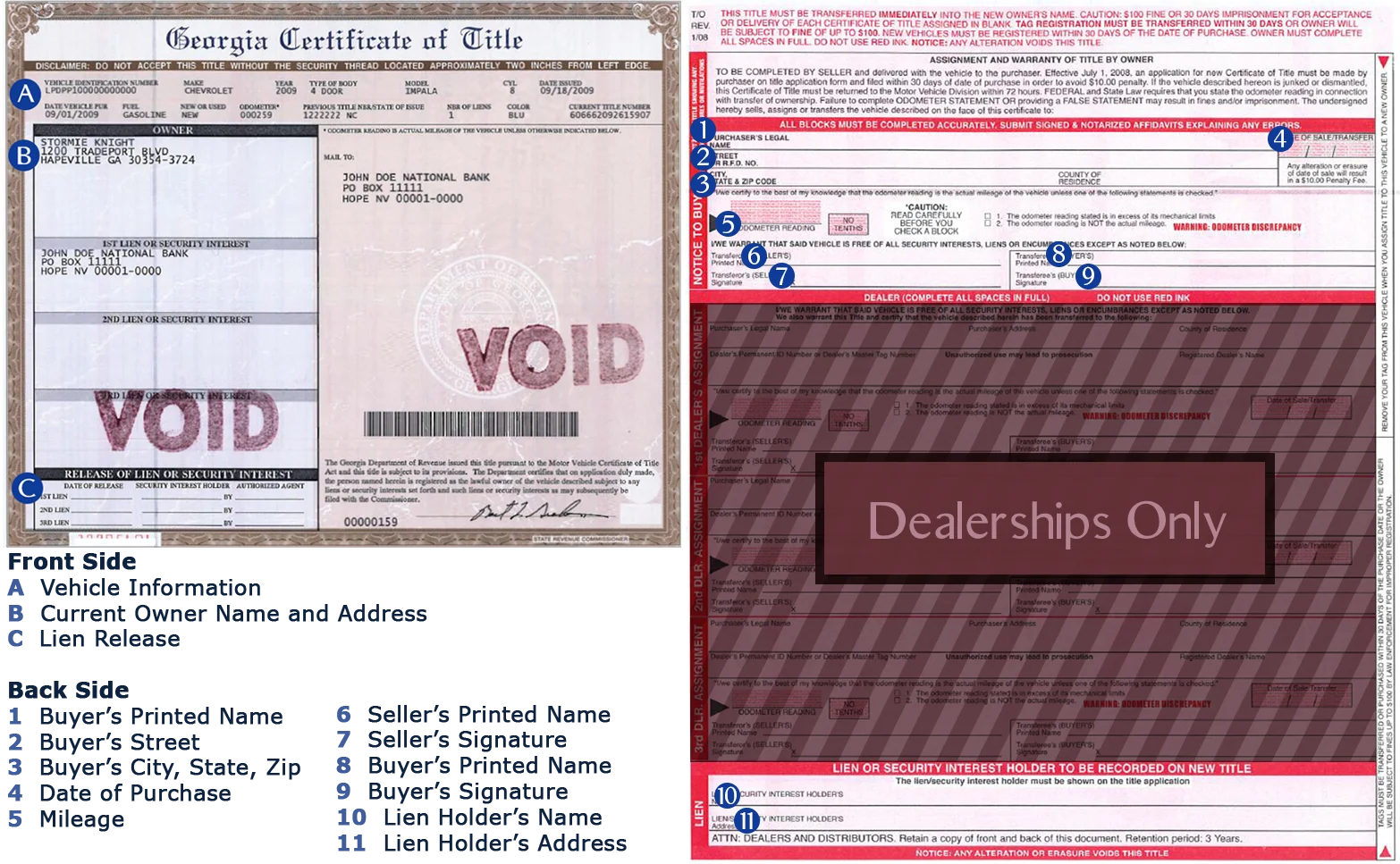

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. You will now pay this one-time. Instead these vehicles will be subject to a new one-time title ad valorem tax that is based on the value of the vehicle.

RV sales tax ad valorem is actually 7. Title Ad Valorem Tax Estimator calculator. Local state and federal government websites often end in gov.

Georgia is exempt from sales and use tax and the annual ad valorem tax also known as the birthday tax These taxes are replaced by a one-time tax called the title ad valorem tax fee TAVT. It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year. The two changes that apply to most vehicle transactions are.

You pay it upfront when you get your tags but its deductible on your Schedule A. Georgia Department of Revenue. Read more and use the calculators at.

Advertisement Family members who receive vehicles from someone who has not paid the GA TAVT have two options. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. This tax is based on the value of the vehicle.

The assessed value is also significantly higher than advertised vehicles now and the NADA RV guide. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. At a market value of 60k-80k that means 4200 - 5600 out of pocket on a vehicle weve already paid sales tax for.

Taking a standard deduction. Public Utility and Flight Equipment Ad Valorem Tax Digest Each year the Department of Revenue goes before the State Board of Equalization for presentation and consideration of the proposed assessments of the Public Utility Ad Valorem Tax Digest. The ad valorem calculation formula for inherited vehicles and those transferred between family members will depend on the age of the vehicle.

Once the GA tag office has processed your application they will issue you a serial plate or T serial plate which you must affix to your trailer. We have since relocated up to Georgia and brought the RV with us. At a market value of 60k-80k that means 4200 - 5600 out of.

I read that values are listed in a manual but havent been able to find that for the Montana 5th wheel 2019 3121RL. RV sales tax ad valorem is actually 7. Title Ad Valorem Tax TAVT - FAQ Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax.

Vehicle Tag Clayton County Ga. Tavt rate of 1 for vehicles model years 1963 through 1985. Georgia Report post Posted January 14 2016 When registering a RV in Georgia be prepared to pay the total ad valorem tax up front.

You only pay this tax one time. The State Board of Equalization was created by statute pursuant to OCGA. TAVT is a one-time tax that is paid at the time the vehicle is titled.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Take your completed forms and payment for the 12 license plate fee plus any payment for any required ad valorem tax to the GA Tax Commissioners tag office in your county. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

Updated April 6 2021 For the answer to this question we consulted the Georgia Department of Revenue. Ad valorem tax is based on the vehicles value and the financial needs of various levying authorities in your county of residence. Title Ad Valorem Tax TAVT became effective on March 1 2013.

Before sharing sensitive or personal information make sure youre on an official state website. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. Archive Ad valorem tax on 5th wheels in Georgia General Discussions about our Montanas. If the previous owner paid the GA TAVT the new owner pays a one-time flat rate of 12 percent.

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

Georgia Listed As A Tax Friendly State For Retirees

Sales Tax On Cars And Vehicles In Georgia

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Taxes Page 2 Irv2 Forums

![]()

Motor Vehicles Franklin County Tax Office

Motor Vehicle Division Georgia Department Of Revenue

Georgia Used Car Sales Tax Fees

Vehicle Taxes Dekalb Tax Commissioner

Titling A Vehicle Cobb Mvd Cobb County Tax Commissioner

Georgia Motor Vehicle Ad Valorem Assessment Manual

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

![]()

Georgia New Car Sales Tax Calculator